Last week’s report carried a somber tone, but for me, it was ultimately a lesson in emotional choice—specifically, how we process pain in the face of tragedy. I chose then, and I’m choosing now, to channel that energy into gratitude.

As for the markets... honestly, who the hell knows anymore? From the Taco trade to the retaliation against the Taco trade, to whimsical policy shifts that seem to carry more weight than actual data or earnings—calamity may just be the theme for the foreseeable future.

This week’s report will be brief. You’ll find the basics below, but I won’t be adding much commentary. No musings on such’s and whatnots this round… I think….

For the Week Ahead:

Check Lemur’s post on X for the full data rundown. There's plenty of important macro ahead, but so far the numbers remain strong. That said, the market continues to prioritize Trump’s offhand remarks over the actual fundamentals and data offered by market participants.

From The Desk of Mr Total

Fiserv (FI) has had a volatile 6 weeks, but recent price action and upcoming events make it my top watch this week . Here’s why I’m tracking this fintech stock.

Fiserv’s challenges started with its Q2 earnings, where an EPS beat was offset by a revenue miss, dropping the stock from $220 to $178. A recovery to $190 stalled after the May 15 JPMorgan conference, where management’s guidance on Clover, Fiserv’s cloud-based POS platform, disappointed. Q2 Clover Gross Payment Volume (GPV) growth, projected to match Q1’s +8% and below consensus, triggered a sell-off to $157. The stock has since stabilized, holding the August 5, 2024, low of $157 but lacking clear recovery signals.

This pullback has compressed Fiserv’s valuation to ~23x forward earnings, a discount from its prior multiple. For a company set to generate $20 billion in revenue and $10+ EPS this year, this presents a compelling risk-reward.

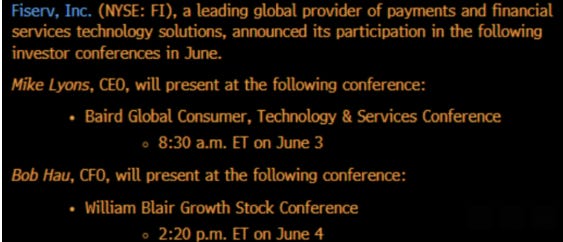

Two events this week could clarify Fiserv’s path:

• June 3 – Baird Conference: New CEO Mike Lyons, succeeding Frank Bisignano (now Social Security Administration Commissioner) on May 7, will present.

• June 4 – William Blair Conference: CFO Bob Hau will provide financial and operational updates.

At the JPMorgan conference, management flagged a stronger H2 2025 despite Q2 Clover growth aligning with Q1. Confirming this outlook is critical. If Lyons and Hau signal robust H2 growth for Clover and Fiserv’s portfolio (e.g., merchant acquiring, payments), the stock could recover. Applying a 17x–18x P/E to a 2026 EPS forecast of $11.91 suggests a $202–$214 price target within 12 months—30%+ upside.

Key Considerations

• Support/Resistance: The stock holds at $157 (August 5 open); a close above $168 could signal recovery, but a break below $157 risks the one-year low of $146.25.

• Analyst Sentiment: Price targets of $190–$200 reflect confidence in Fiserv’s long-term growth despite near-term challenges.

• Clover’s Role: Processing $272 billion in annualized payment volume, Clover is a growth driver. Positive updates on adoption or margins could spur a re-rating.

Risks include further negative guidance, especially if Clover growth lags or macro pressures (e.g., SMB spending slowdown) persist, potentially pushing the stock to $146. However, a strong H2 outlook and Lyons’ leadership could be a turning point. Fiserv’s diversified model—merchant solutions, banking tech, global payments—adds resilience.

Fiserv’s sell-off could offer an attractive 12-month entry point. Its reduced multiple, solid fundamentals, and analyst support suggest the upside outweighs downside risk. Lyons and Hau’s commentary this week will determine if the recovery begins or the stock tests lower support. Fiserv’s scale and growth prospects make it a company to watch.

What I will be looking for this week :

• H2 Clover growth confirmation.

• Lyons’ strategic priorities as CEO.

• Updates on margins, synergies, or capital allocation.

• Price action post-conferences, especially a close above $168.

Fiserv is my top pick to monitor for price/option flow and management commentary.

Best of luck to everyone.

The information provided is for informational purposes only and should not be considered financial, investment, or trading advice. It is not a recommendation to buy, sell, or hold any securities or financial instruments. Please conduct your own research and consult with a licensed financial advisor or other qualified professional before making any investment decisions. Investing involves risk, including the potential loss of principal.

My Take:

Can we talk about Total’s call on GAP last week? Good lord—that was excellent work. As for this new idea? Trading around the conference on the 3rd feels smart. Near 52-week lows, there’s definitely potential for a pop—especially if the markets cooperate. Like Total mentioned, their spot in the fintech space is pretty unique, so messaging from the CEO on the 3rd could be the spark it needs.

Chart of the Week:

Last week, we called for chop inside a defined range—and we didn’t really get it. Instead, we got something much more interesting: a failed breakout and a failed breakdown in the same week. That kind of action doesn’t just happen without some fuel—policy shenanigans, strong NVDA earnings, and macro data that was about as perfect as anyone could ask for.

Here’s a 4-hour chart of QQQ:

Plan:

Bull case: Bulls must recover and hold 520. This matters a lot, especially since we barely closed above our 518 pivot—something we only managed after a late-day rally. If that move sticks, we could see a push to 522–525, setting up another shot at breaking the 2023 low trendline.

Bear case: Bears need to press below 518. 515ish is the next key level down, and a clean break below 511 opens the door to 508 for a possible “prayer bounce.” The real target? 491. Bears have been eyeing that for weeks.

My bias?

I’m just going to stick to the levels. I can’t predict whatever the hell the President is going to babble about this week, so I have no choice but to stay small, use stops, and read the chart. His randomness creates flash volatility that’s fun if you’re not in a trade… and absolutely brutal if you are and it moves against you.

I lied—I do have some commentary.

Look, I want the president—any president—to have the leverage to negotiate strong, fair trade deals for the American people. That’s not partisan, that’s just smart. But there’s a difference between leverage and chaos. You can’t run a country—or a market—on impulse. You can’t build, hire, expand, or trade with confidence when every morning begins with, “What the hell did he say now?” or “when is he scheduled to speak again”

Let’s just call it. Right now, the biggest obstacle to this market ripping to all-time highs isn’t inflation. It’s not earnings. Hell, it’s not even the Fed—though yes, those booger-eating dorks don’t help. No, the problem is Donald J. Trump and his complete lack of consistency, strategy, or respect for process.

Some of you will call that “never Trump” talk. Fine. But I’ve praised plenty of his trade decisions when they were rooted in actual strategy. What I won’t do is pretend this current behavior is normal. If your entire defense of this man is to shout “but Biden! but Killary! but Obama!”—you’re not serious. You’re not engaging with policy. You’re just trying to “own the libs” like some cracked-out cult survivor from the Jim Jones era.

Friday was a perfect example. A 50% steel tariff was tossed into the public square mid-speech, with zero planning, zero coordination, and no policy apparatus behind it. That’s not negotiation. That’s flailing. That’s a Molotov cocktail lobbed into a market trying to price real risk.

Here’s what matters: we have checks and balances in this country for a damn good reason. No single person gets to dictate economic policy by whim. If you disagree please take a Civic 101 Class….. Last week, Trump’s unilateral tariff initiative was finally challenged, and now it’s headed to the Supreme Court. Good. That’s how the system is supposed to work. One of his own defenses is that it would take congress too long and that we wanted to move fast…. I get it.. but if you are going to brake things along the way at least have the courtesy of being measured with a clear policy.

And let me remind you—Trump did not win the popular vote. More Americans voted against him than for him. That’s not meant to inflame, it’s a fact. Which means he was never handed a personal mandate to do whatever the hell he wants. That’s not how this republic operates.

So yeah, that’s where I’m at. We’re not trading on fundamentals or flows right now—we’re trading on presidential mood swings and social media outbursts. And that’s not a market. That’s a hostage situation for some and Stockholm syndrome for others.

HellsBells Cofounder The Roadhouse NOT FINANCIAL ADVICE: If you find this information useful and would like live market play by play please dm me @ hellsbells@substack.com Instagram https://twitter.com/HellsBellsBBS BLACKBOXSTOCKS

https://staygreen.blackboxstocks.com/SHQl

Fucking Trump is just willy-nilly on everything. You are 100 percent correct is pure chaos right now and no one knows what to do next. For now the momentum trade is all we have. Fuck him and his bs policy whatever that may be. Coming from a righty they are all destroying the American dream and we are going nowhere fast! We need a real fucking leader. Hells time for you to run I'll be your VP 😁❤️

Hi everyone,

I want to clarify something from my earlier post. I misspoke when I said Trump didn’t win the popular vote. What I meant to say—and should have said more precisely—is that while he won the presidency, he did so with less than 50% of the popular vote. That’s a mathematical fact, and it means he did not secure a majority of the votes cast.

This wasn’t a sweeping mandate from the American people—it was a plurality win. Hopefully this clears that up.