So last week my internet was down pretty much all weekend, which gave me the perfect excuse not to write. And this week? I kinda wish I didn’t have the internet…

What stood out last weekend was that the world keeps spinning just fine without being constantly connected. In a lot of ways, it actually clears space for the stuff that matters. Especially when you compare it to this weekend—where everything, everything, has been twisted into some nonstop political circus.

Now, I get that some folks love to yell, “I don’t like politics!” or “I don’t want to talk about it!” But when politics hijack monetary policy, fiscal policy, and both geo and domestic fronts start looking like a flaming dumpster full of horse shit—well, maybe the internet and our shiny new society are exactly what you ordered.

But fear not I offer you some smooth instrumentals from Pink Floyd!

The Week That Was:

We all saw the war headlines, politicians getting targeted or killed, and the ongoing mess that is our current immigration policy. But the real story last week? FOMC—and Jerome Powell’s continued inability to be anything other than a wet blanket on a cold and windy night.

For months, the data has pointed toward a smooth path to easing. Inflation's been trending the right way, labor is cooling, and yet Powell refuses to even hint at future cuts. Instead, he’s doubling down—keeping money more expensive than it needs to be and keeping his foot on the neck on 80% of the American people(fuzzy math).

I could maybe stomach this if the economy was booming, but with GDP projections getting slashed and unemployment expected to rise if even just incrementally, it begs the question: why is Powell so willing to watch the economy crater before doing anything? Oh and when asked about AI he wont even acknowledge the pending white collar and manufacturing job loss nor can he even comment on the current deportation impact on labor… Its like WTF dude… these things matter when it comes to monetary policy and the impact on your supposed dual mandate lie….

To me, this is the real story inside the market. Unless tensions escalate into a full-blown war with Iran or they decide to shut down the Strait of Hormuz (which would hurt them more than us), we’re likely in for a bumpy ride—just not for the reasons most headlines are screaming about.

The Week Ahead:

Domestic Data:

It’s a heavy week for economic data—PMIs, Consumer Confidence, PCE, GDP, Home Sales, and Durable Goods all hit. On top of that, Powell will testify before Congress for two days. Once again, the politics of politics will take center stage.

Foreign Data:

We’ve got inflation data coming out of the EU and Canada this week. So far, we haven’t seen any major spikes since tariffs went into effect—but that calm could be short-lived. Add in rising crude prices from war fallout, and the setup for a real inflation flare-up is there.

The question now is whether this week’s data reflects a one-off pop—or the early signs of a broader inflation trend fueled by trade friction and energy shocks. Either one could throw a wrench into any easing narrative, justified or not.

Geo-Politics:

Too much to cover, and honestly, hard to believe anything improves in the near term. Trump teased more trade deals late last week—maybe something materializes? Or maybe it's another two-week storyline that fades into the ether.

Earnings to Watch:

MU (Micron): Needs to post strong numbers to justify its recent run.

CCL (Carnival): Squarely in the headline crosshairs—guidance will be critical.

NKE (Nike): I’m watching closely for commentary on tariffs and China sales.

FDX (FedEx): Always a good read on macro freight and demand trends.

Market Overview:

Overall, the markets have handled the current climate better than anyone could’ve expected—coming within a whisper of all-time highs just a few days ago. But as the week progressed and tensions built heading into the FOMC, some of that upside momentum started to fade.

The key thing to remember: we’re in a headline-driven market that wants to go higher. Powell took some of the steam out of that. The lack of meaningful trade progress is dragging things down. And geopolitics just flipped on its head—with Iran now joining Russia as another major energy power actively at war. You could probably throw the U.S. in that sentence too… but I’d rather not. Oh and all is very quiet on the Big Beautiful Bill front…

Also, there is some very bearish flow lingering out there. Does it have to play out? No. But from a technical standpoint, a cool-off in the current structure wouldn’t be a surprise—and we’ll dig into that below.

From The Desk of Mr Total:

In my career, I’ve learned that forcing an idea often signals it’s time to step back and let the market settle. After the recent attack on Iran, I’m comfortable assessing the situation from the sidelines. While I believe markets will grind higher despite geopolitical tensions and that tariff concerns are largely priced in, I’m not ready to act or propose ideas this week. The post-attack uncertainty at least for me calls for patience, but this week offers valuable opportunities to gather insights for the upcoming earnings season.

Key events to watch:

Earnings from FDX, MU, and NKE: Their commentary, outlooks, and guidance could reveal trends in global trade, tech demand, and consumer sentiment, helping gauge tariff impacts.

Powell’s Testimony and Fed Speakers: Expect more of the same from last week, but listen for any new signals on rates or inflation.

Bank Stress Test Results: These could signal the health of financial institutions amid economic uncertainty.

Economic Data Releases: A slew of reports will provide context for market moves.

Market Reactions Post-Attack: Monitor USD strength, Treasury yields, WTI crude, and precious metals for clues on sentiment.

JP Morgan Energy, Power, Renewables, and Mining Conference: Offers continued insight into nuclear, solar, and big oil sectors.

My strategy this week is simple: exercise patience. Let the market reveal its hand through these events and sentiment shifts before deploying capital.

Wishing everyone clarity and success this week.

My Take:

I wish I would have read his part before I started writing… lol great note of the stress test, i missed that one. Again when you are seasoned like Total you know what type of playing surface you perform at your best and he is right there is no reason to force anything right now.

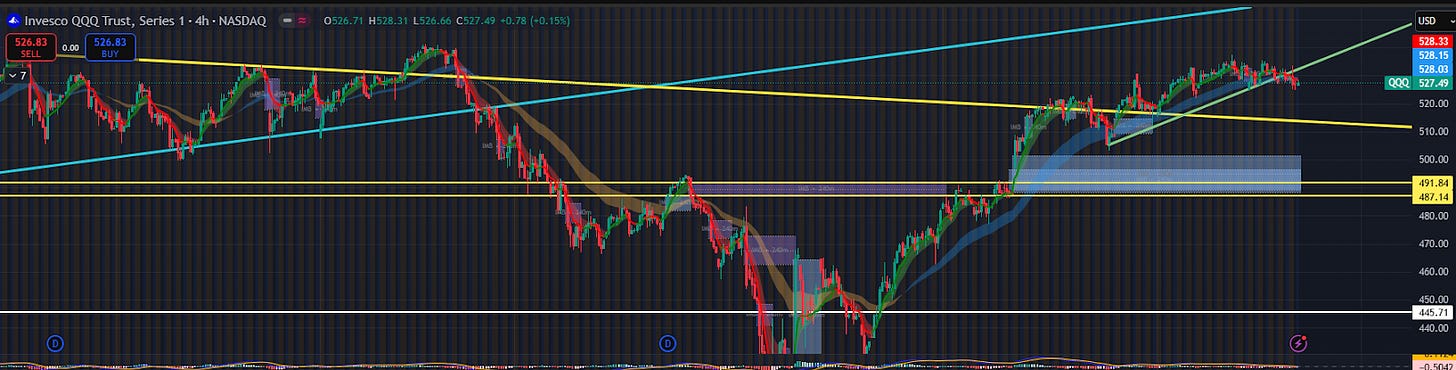

Chart of the Week: QQQ

I’ve been looking for a meaningful pullback in the markets for almost three weeks now. And somehow—despite everything thrown at it—the market just kept grinding higher.

Then came Wednesday… and Powell’s disaster of a speech. It might end up being the catalyst we look back on in a few weeks as the turning point. Or—just as likely—he changes his tone during this week’s testimony, and the whole thing becomes another "buy-the-dip" moment triggered by war headlines fading.. Again the Politics of Politics….

Like I said up top: this is a headline-driven market

Even though we lost that greenish trendline on Friday, the structure for an inverse head and shoulders is still very much intact. The question now is: where does the bottom of that right shoulder land?

Plan:

Bull Case:

Bulls need to reclaim the 529–530 zone ASAP. I’m assuming futures gap down Sunday night, but as we saw last week, a selloff can get bought just as quickly. Reclaiming that level opens up 534, and from there, we could see a real push—with squeeze potential—toward all-time highs.

Bear Case:

Bears need to defend this exact same area. If we do gap down into Monday, the key level shifts slightly lower—to around 527. A confirmed break below 524 could quickly push us into the low 520s and open the door for a test of 518—something we’ve talked about over and over. Lose 518, and we’re likely heading for 509.

And then there’s the gap at 490. I’ve been watching it for what feels like forever, and we haven’t even come close. But the setup is there to fill it without breaking the longer-term bullish structure.

But again—this is a headline-driven game.

Too many moving pieces to just set it and forget it.

Not really sure how I want to close it out this week.

I read the headlines from the weekend… then made the mistake of turning on the TV to see the coverage—and that same sinking feeling hit: what’s the point? What’s it all really for, when we can’t even unite around something as existential as the threat of war—or the very idea that built this country in the first place: immigration.

In sports, in business, hell—even in elementary school kickball—you look to the leader to bring people together. To build consensus. But that’s not what we have. We’ve built a system that rewards division, one that feeds on resentment toward our own neighbors.

There’s no such thing as civil discourse when the Vice President visits a state like California and blocks out the local press. Just like it’s absurd to see the President express empathy for migrant and hospitality workers for all of 38 seconds—only to immediately cave to a base obsessed with punishing brown people while whining about $5 tomatoes.

What we’re missing—what we’re starving for—is leadership. Real leadership. Not the kind that performs for cable news. Not the kind that plays to social media. The kind that listens. The kind that unites. The kind that takes the hits and still shows up to bring people together.

But the truth I keep circling back to is this: unity doesn’t pay the bills for politicians who thrive on chaos. There’s no profit in calming things down when stoking outrage keeps the machine running.

Unity isn’t deploying U.S. troops to police Americans. It isn’t ICE agents rolling through neighborhoods dressed like thugs instead of federal officers(I thought masks were for libtard losers? Remember????

And every time I see someone post “this is what I voted for”—I want to ask:

Really?

Be honest. Set tribalism aside for just one second.

Is this really what you voted for?

A country teetering on war and bankruptcy. A nation unraveling at the seams. And the people in charge? Tossing out sound bites and mean tweets like it’s all just some game.

Really?

Next week maybe I will have something to say on Iran, I have a lot of thoughts on this and need to let them settle a bit…

HellsBells Cofounder The Roadhouse NOT FINANCIAL ADVICE: If you find this information useful and would like live market play by play please dm me @ hellsbells@substack.com Instagram https://twitter.com/HellsBellsBBS BLACKBOXSTOCKS

https://staygreen.blackboxstocks.com/SHQl